Transforming millions of African lives for generations to come.

Contributing knowledge, technology and funds to the local economy and providing tools for individuals to take responsibility for their own development.

“Upholding the dignity of the human person through investment, business and work.”

~ Purpose Statement of Jumpstart Africa

ORGANIZATIONAL BACKGROUND

Lack of material resources reduces ability to live the Gospel

For the last twenty-five years Fred Mawanda and his wife Pauline Tumugonze have been leading community development, self-sustenance initiatives and savings and credit start-ups. For the last twelve years they have been focused on evangelization of young people, especially from the universities, with a vision of empowering them to be an influential force of renewal in Church and society. This recent focus has included upfront evangelization outreaches, leadership development and socio-economic initiatives. The socio-economic initiatives include entrepreneurship training, savings programs, and direct credit for individuals and groups.

Through the years they have observed individual’s lives after encountering Christ being eroded by lack of resources, poor utilization of God given talent and inability to meet basic human needs. This lack of material resources especially start-up and growth capital reduces their ability to live the Gospel. It is the drive to address this injustice that forms Fred and Pauline’s purpose …

IMPACT AFRICA FUND

Grant Proposal Information

Purpose of Request and Anticipated Results

AIJB seeks a grant (or a combination of grants) totaling $150,000 in support of technology investments and loan portfolio expansion for Jumpstart Africa Investment Services ...

Organizational Capacity

The organization has the capacity to make a leap from a largely paper-based and mobile phone system to fully digitized system based on the foundation it has built to date ...

Strategic Affiliations

JSA has aligned with several individuals and organizations in support of its mission. The following is a listing of these affiliations ...

Grant Payments and Contact Information

Grant payments can be made in cash and via cryptocurrency. Please click for further information.

IMPACT AFRICA FUND

FAQ

Financial access is the single biggest hindrance to both the establishment of new African enterprises and the growth of existing ones. It is estimated that the continent’s formal SME sector has an annual financing gap of over US $136 billion, according to Oumar Seydi, International Finance Corporation Regional Director for Sub-Saharan Africa. Of critical importance in his statement is that SMEs account for 90 percent of all businesses in Africa. These numbers show that the investment potential of the African continent can and will only be unlocked by financing the SME sector. This reality is underpinned by the fact that Africa’s population is predicted to double in just over 25 years, creating unprecedented market potential.

Reference link

WOMEN ARE UNDERSERVED IN ACCESS TO LOANS

Women are 53% of the total population.

Women face higher constraints in accessing start-up and growth funds.

In Uganda, women only access 9% of the available credit.

- 38.8 million people (76% rural, 24% urban)

- 22% of adults are excluded from access and usage of financial services

- 20% of adults use only informal financial services

In partnership with local organizations, the Fund will be able to reach and impact these women directly.

“In developing countries, women play a pivotal role as risk managers and drivers of development, particularly in settings of severe poverty. Microfinance programs have enabled thousands of women to use small sums in creative and successful ways to develop livelihoods, improve their families’ well-being, and build up savings.”

GETTING ACCESS TO FINANCIAL SERVICES HELPS PEOPLE IMPROVE

Many development experts agree that microfinance, when properly harnessed and supported, can economically empower individuals and small enterprises and enable them to contribute to and benefit from economic development. Having access to financial services helps people improve their lives and work their way out of poverty. Indeed, growth of the microfinance industry was central to the social progress achieved in South Asia in the past four decades, even though the microfinance industry in India and Bangladesh is facing challenges. The African microfinance sector can benefit from the best practices and lessons of South Asian experience.

Reference link 1

Reference link 2

THERE ARE FEW OPTIONS FOR AFRICANS

Poor households and individuals, for their part, have difficulty proving their creditworthiness because they lack clearly defined property titles and other assets acceptable as collateral. Their only alternatives are to seek loans from informal moneylenders or to draw on savings, options that are costly and risky.

MICROFINANCE IS NOT A MIRACLE SOLUTION, BUT IS A CRITICAL PIECE NEEDED TO SUCCESSFULLY COMPLETE THE DEVELOPMENT PUZZLE IN SUB-SAHARAN AFRICA

Microfinance on its own is not a miracle solution to eradicate extreme poverty. The experience of South Asia and other regions demonstrate that microfinance can deliver positive effects only when it is combined holistically and integrated effectively with other economic and social programs to meet the diverse needs of the poor and help lift them from poverty.

Microfinance offers significant opportunities for African countries to fully unleash the private sector’s potential and contribute to addressing emerging and long-lasting development challenges such as poverty, income inequality, high levels of unemployment, particularly amongst its youth, and the achievement of the UN Millennium Development Goals (MDGs). It is estimated, however, that as of 2007 only around 12.7 per cent of the poorest families in Africa had access to microfinance services compared to 78.5 per cent in Asia.

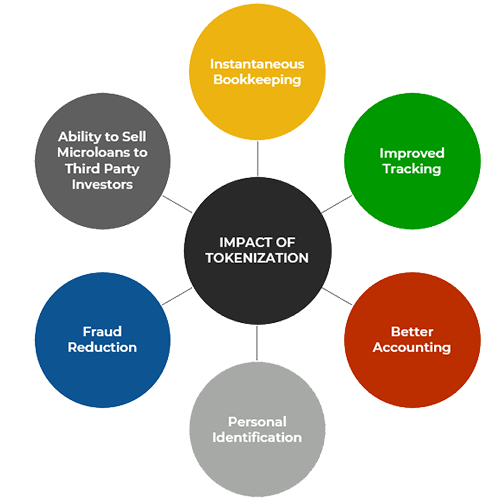

In general, a token was previously defined as a representation of the right to a service an asset. We broaden this definition to also include the token as a reference to an underlying stream of data on the blockchain, comprised of the transaction’s event series.

Our definition of a “regulated token” is a combination of DLT transactions that connote ownership—represented by a typical DLT token—and the associated documentation that is referenceable by way of the associated smart contract ownership information and information that is embedded in the documentation-based DLT transactions event series. It is important to note that this new, broader token model can be implemented using the existing Ethereum DLT components of transactions, smart contracts, and ERC-20 tokens, or similar components from like DLT platforms.